It’s no secret that having bad credit can cause problems. It can make it hard to get a job, impossible to rent an apartment and even impact your ability to buy a car or home. But there are things you can do to fix your credit. Here are four simple steps that will help you get started.

Step 1: Get An Insight Into Your Current Credit Score

What is your credit score?

It’s a number that ranges from 300 to 850 that quantifies how likely you are to pay back the money you’ve borrowed. If your credit score doesn’t qualify to the suitable level, you seek out credit help anytime before it gets too late. Moreover, your credit score determines the interest rate lenders will charge you when borrowing money. (Credit Information: https://creditmagic.net/credit-info.html)

A high score can save you thousands of dollars and protect your finances. It can also make it easier to qualify for other financial products like insurance and apartments.

Step 2: Establishing A Credit History

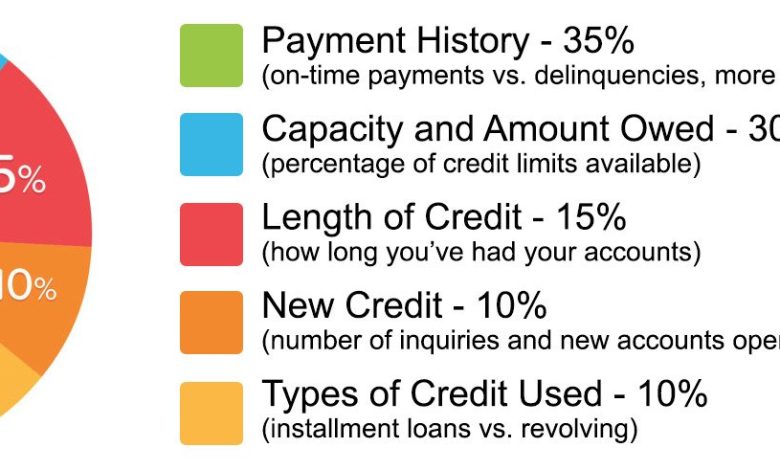

If you don’t have any loan history, or if it isn’t positive, it can be hard to get approved for loans. When you apply for a loan, the lender will check your debt history. This is what they’re checking:

- Do you have any instances of late payments, defaults, or bankruptcies on your record?

- How many accounts do you have with negative information listed in your file?

- Since how long has the negative information in your file been in there?

If you haven’t used it before, it’s essential to start slowly. If you have a card or loan and don’t pay on time or default on a loan, that can damage your score even more than not having any.

Step 3: Manage Your Credit Cards

If your score is low because of past problems, you might not qualify for a traditional account like a loan card.

The bank often requires you to deposit a certain amount, anywhere from $300 to $1,000, before approving the account. They want to ensure that if something happens and you can’t pay back your debts, they still have some collateral.

Step 4: Check Your Credit Report

Your credit report is a record of your activity that banks, lenders, and other companies check when they decide whether or not to do business with you. It includes things like:

- How often you make your payments on time

- What is the total amount of debt you have

- How much available debt you are left to repay

- Amount you owe on your loan accounts and which ones have gone up in the last year

Your report is composed of two reports: one from the two main bureaus, TransUnion and Equifax. Make sure you check both reports for accuracy when you pull them. If they’ve made a mistake on your report, you can dispute it and have a corrected copy sent to anyone looking at the inaccurate information.

Step 5: Take The Help Of Free Credit Report websites

To get your report for free, you can use any free online website.

Several websites on Google let you get access to your credit results for free. You just need to search for the right website.

Additional Help On Managing Credit Score

If you want to take more control of your credit score, know that websites and even apps are available in the market to help you. From the time you opt for a loan from your card to when you bought your first car or home, these sites keep track of your every debt. What’s more, they even help you figure out which changes can improve your score and provide step by step guidance on how to do it.

And also, you can work on building good financial habits to improve your score.

- Always pay your debt on time, even if it’s the smallest debt( like phone bills )

- Try not to spend more than 30% of your credit limit every month

- Save cash to use instead of putting expenses on credit card

You may be wondering how to fix your credit score. We’ve outlined the steps you need to follow, and we hope that our advice will help guide you on this journey of improving your credit rating. Furthermore, Credit magic LLC is always by your side if you seek professional assistance. They can help you manage your debts, increase your income, and maintain a good loan score year-round. Feel free to reach them out for credit help anytime.